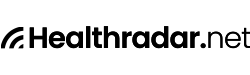

Full-body MRI scans provide comprehensive, non-invasive imaging of all major organ systems in a single session. Originally niche and costly, they’ve surged in popularity among wellness-focused consumers willing to pay out-of-pocket for early detection of tumors, vascular issues, degenerative changes, and other asymptomatic pathology. Advances in AI, faster sequences, and direct-to-consumer models are making full-body MRI a burgeoning segment of the preventive-health market.

What Is a Full-Body MRI Scan?

A full-body MRI uses magnetic resonance imaging to capture high-resolution images of the brain, spine, chest, abdomen, pelvis, and extremities in one appointment. Unlike symptom-driven MRIs ordered by physicians, these scans screen healthy or minimally symptomatic individuals for early warning signs, creating a “baseline” health map.

Key Trend Drivers

-

Preventive Health Culture

Wealthy wellness seekers embrace annual or biannual full-body scans as part of a “health-span” strategy, aiming to catch disease before symptoms emerge. -

AI & Rapid Imaging Advances

New AI-driven reconstruction and accelerated pulse sequences reduce scan time (< 20 min) and improve image clarity, enhancing patient comfort and throughput. -

Celebrity & Influencer Endorsement

Public figures sharing their scan experiences have spurred mainstream curiosity and demand for VIP screening services. -

DTC & Subscription Models

Start-ups (e.g. Neko Health, Lindus Health) offer standalone or subscription scan packages outside traditional insurance, simplifying access and billing.

Target Consumer Profiles

| Segment | Characteristics | Motivations |

|---|---|---|

| Affluent Wellness Seekers | High disposable income, proactive health | Early disease detection, peace of mind |

| Biohackers & Quantified Self | Data-driven, track multiple biomarkers | Comprehensive health metrics |

| Aging Professionals (50+) | Family history of chronic disease | Preventive screening, longevity planning |

| Executives & Celebrities | Image-conscious, trend-driven | Access to elite healthcare services |

| Corporate Wellness Clients | Employer-sponsored health benefits | Reduce downtime, improve workforce health |

Health & Functional Benefits

-

Early Tumor Detection

Small neoplasms (e.g. early-stage cancers) identified before clinical symptoms, improving treatment outcomes. -

Vascular & Cardiac Screening

Aneurysms, stenosis, and myocardial tissue changes detected, enabling proactive cardiology referrals. -

Musculoskeletal Assessment

Joint degeneration, disc herniations, and muscle injuries revealed for early orthopedic intervention. -

Neurological Baseline Mapping

White-matter lesions, microbleeds, and structural anomalies flagged for cognitive-health monitoring. -

Holistic Health Dashboard

Creates a year-to-year internal “baseline” that integrates with wearables and lab data for precision-wellness planning.

Market Dynamics & Size

-

Global MRI Equipment Market

Valued at USD 6.65 billion in 2023; projected to reach USD 12.5 billion by 2033 (CAGR 6.5%). -

Full-Body Scanner Segment

Estimated at USD 153 million in 2022; forecast to grow to USD 302 million by 2027 (CAGR 14.5%). -

DTC Scan Services

Private vendors report monthly revenue growth of 20–30% as affluent clients adopt subscription screening. -

Regional Concentration

Early adoption in North America, UAE, UK; expected expansion into Asia-Pacific luxury and medical tourism hubs.

Service Formats & Innovation

| Format | Description | Use Case |

|---|---|---|

| One-Time Comprehensive Scan | Single session + radiologist report | Baseline health assessment |

| Annual Subscription Scans | Yearly scan + longitudinal comparison + physician consult | Ongoing preventive monitoring |

| AI-Augmented Rapid Protocols | Full-body in < 15 min via AI reconstruction | High-throughput screening |

| Hybrid Imaging Packages | MRI + CT, DXA bone density, vascular ultrasound | Multi-modal diagnostic profiling |

| Corporate Wellness Programs | On-site or partner-clinic scan bundles for employees | Employee health benefits |

Challenges & Considerations

-

False Positives & Overdiagnosis

Incidental findings often trigger follow-up tests, biopsies, and anxiety, requiring careful management protocols. -

High Cost & Accessibility

OOP prices (USD 1,000–3,000 per scan) limit reach; equity concerns for broader populations. -

Clinical Appropriateness

Major societies (USPSTF, ACR) do not endorse routine asymptomatic full-body screening, citing unproven mortality benefit. -

Data Privacy & Management

Large imaging datasets demand robust cybersecurity, HIPAA/GDPR compliance, and clear patient consent workflows.

Future Outlook & Opportunities

-

Evidence-Based Protocol Optimization

Large-scale studies to refine target populations, scan intervals, and anatomical focus for maximal ROI. -

Insurance & Reimbursement Pathways

Partial coverage models for high-risk groups (e.g. familial cancer syndromes) to improve access. -

Digital Health Integration

Fusion of MRI data with wearables, genomics, and labs into AI-driven precision-prevention dashboards. -

Global DTC Clinic Franchising

Licensing pod/scanner technology to providers in emerging markets as part of luxury wellness resorts.

Conclusion

Full-body MRI scans are emerging as a premium pillar of preventive health, offering unparalleled internal visibility to those who can afford it. Balancing innovation with evidence-based guidelines, cost management, and responsible follow-up will determine whether full-body MRI becomes a mainstream tool in precision wellness or remains an exclusive luxury for a select few.

Sources

- https://www.gminsights.com/industry-analysis/full-body-scanner-market

- https://www.grandviewresearch.com/horizon/outlook/whole-body-imaging-market/united-states

- https://www.statista.com/statistics/1125123/mri-equipment-market-size-globally/

- https://time.com/6304107/full-body-mri-health-scan/

- https://www.marketsandmarkets.com/Market-Reports/full-body-scanner-market-145680532.html

- https://www.towardshealthcare.com/insights/mri-market-sizing